Gift Card Accounting | Liabilities and Revenue

Each country treats the accounting of gift cards differently.

In this article we will review how to properly account for Gift Card sales in the United States and Canada.

This is not advice. Please consult with an accountant for proper record keeping.

The following may vary jurisdiction by jurisdiction. Again – please consult with an accountant to come up with a method for accounting for gift card sales.

When you sell gift cards, you have the money in hand, and presumably, that means you should just record this as a sale. This is incorrect. You need to record gift card sales as liabilities for deferred revenue in the United States and Canada.

To explain, a liability is a debt or a future obligation. When you sold the gift card, you created a future obligation to provide your customers with products or services worth the value of the gift card.

Deferred revenue means you wait until you count the funds as sales — or in more easily understood language, the time when your customer trades the gift card for goods or services. To illustrate how this works, imagine you sell a gift card for $100. To record the transaction, you account for the $100 as a liability. Then, let’s say the customer uses $80 of the gift card to purchase some products from your store. At that point, your outstanding gift card liability is reduced by $80. If this is the only gift card on the books, the total in that column drops to $20. To balance the books, you also record the $80 as sales revenue.

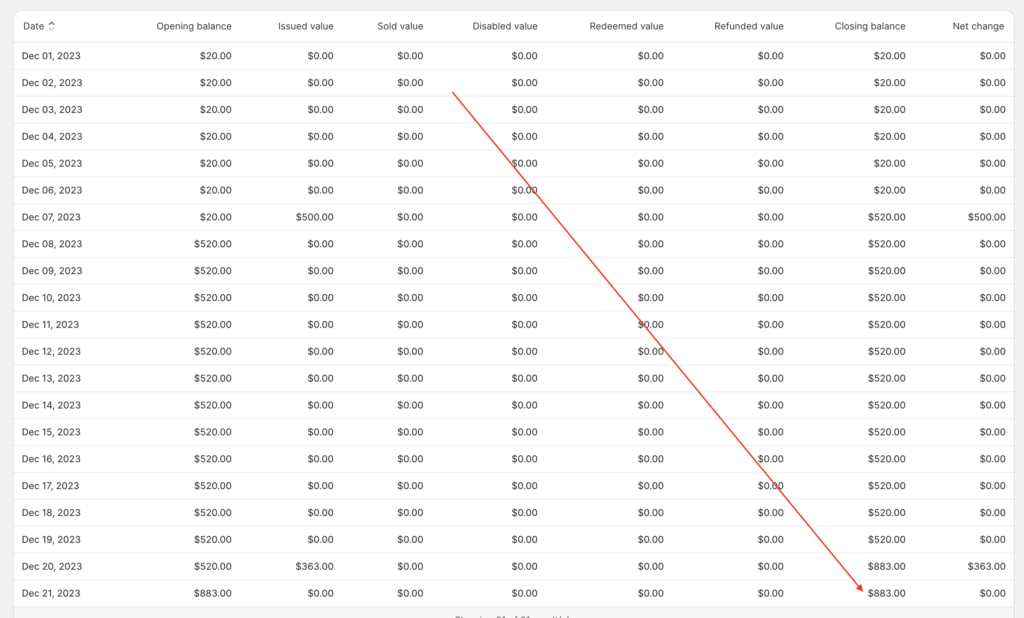

At any time, within Shopify, you can see your outstanding gift card liability report by going to Reports –> Gift Card Balance.

Here you will see several columns, including Opening Balance, Redeemed Value, and Net Change.

By default Gift Cards sales are counted as sales and not liabilities by Shopify.

To get accurate numbers over a certain period of time, do the following:

Total sales = Total Sales – Gift Card Sales

Total Liabilities = Go to Reports –> Gift Cards Balance –> and see the total at the bottom of the Closing Balance Column:

Additional documentation around the legal requirements can be found here:

Canada: https://www.canada.ca/en/financial-consumer-agency/services/payment/gift-cards.html

United States: https://www.firmofthefuture.com/bookkeeping/gift-card-accounting-part-1-the-gaap-standards/